Services > Special

Compliance or KYC?

Compliance regulations and KYC regulations are two different sets of rules that a company must follow in order to act lawfully and ethically. While compliance regulations cover a broader range of regulations, KYC regulations focus specifically on customer identification and verification. The differences between these two regulations are explained below:

KYC regulations:

KYC regulations specifically focus on identifying and verifying customers to ensure they are legitimate and not engaged in illegal activities. The KYC process involves collecting and verifying customer information such as name, address, and identification documents. The purpose of KYC is to prevent financial crime by verifying the identity of customers and detecting suspicious activity.

Compliance regulations:

Compliance regulations refer to rules that companies must follow to prevent and detect financial crimes such as money laundering, terrorist financing, and fraud. These regulations are designed to ensure that companies operate in a legal and ethical manner and do not engage in activities that could harm society. Compliance rules include a number of regulations, such as anti-money laundering (AML), counter-terrorist financing (CTF), and sanctions compliance.

Procedures and activities for compliance and KYC:

In order to comply with both compliance and KYC regulations, a company must establish procedures and activities to ensure that it meets the legal requirements. These procedures may include the following:

Compliance:

- Conducting risk assessments to identify potential areas of risk for financial crime.

- Implementing policies and procedures to mitigate identified risks

- Ongoing monitoring of customer transactions to identify suspicious activity

- Conduct regular employee training on compliance regulations

- Conduct regular audits to ensure compliance with regulations

KYC:

- Collecting customer information, such as name, address, and identification documents.

- Conduct customer due diligence (CDD) to verify the identity of customers

- Implement procedures to monitor customer activity on an ongoing basis to identify suspicious behavior

- Conduct regular employee training on KYC regulations

- Conduct regular audits to ensure compliance with regulations

Monitoring intervals:

Both compliance and KYC measures must be monitored and adjusted regularly to ensure they remain effective and compliant. Specific intervals may vary depending on the size and complexity of the organization and the scope of regulatory requirements. However, it is generally recommended that compliance and KYC measures be reviewed and updated at least annually. In addition, any changes to the company's regulations or business model should prompt a review of compliance and KYC measures to ensure ongoing compliance.

Who monitors compliance and KYC:

Compliance and KYC measures are typically overseen by a dedicated compliance team within the company. This team is responsible for ensuring that the company complies with all applicable regulations and that the KYC process is effective in detecting and preventing financial crime. The compliance team should have access to resources such as legal experts and technology tools to help them monitor and adjust compliance and KYC measures.

Conclusion:

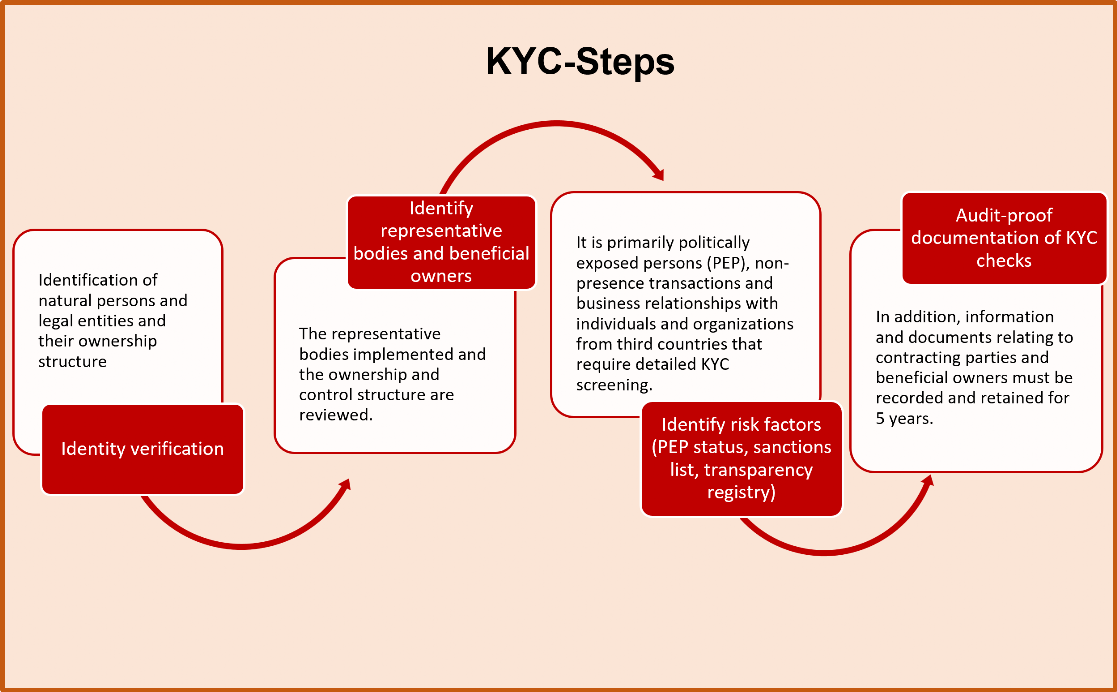

Know Your Customer (KYC), as part of general due diligence, is an important component of risk management under the Money Laundering Act ("AMLA"). It is primarily applied in the course of customer acceptance processes - so-called onboarding. KYC describes all the necessary steps that serve to identify the customer and are used to assess the associated risk.

Involvement in money laundering activities, fraud, corruption, terrorist financing or other white-collar crime can lead, among other things, to financial damage as a result of fraud, heavy fines to the legislature or permanent damage to the company's image and loss of public confidence.

In addition, guidelines are being tightened more and more to counteract the increasing money laundering activities. KYC will definitely go from a "nice to have" to an absolute "must have" in the business landscape in the next few years.

We help you to map and implement all relevant steps.